What is Balance of Payments?

Balance of Payments is an accounting record of all monetary transactions between a country and the rest of the world

Important Points

- BOP is a record which countries use to monitor all international monetary transactions at a specific period of time.

- All trades conducted by both the private and public sectors are accounted for in the BOP in order to determine how much money is going in and out of a country

- If a country has received money, this is known as a credit, and, if a country has paid or given money, the transaction is counted as a debit.

- Usually, the Balance of Payments is calculated every quarter and every calendar year.

Components of Balance of Payment

Balance of Payment is classified into three categories. These are:

The current account

It includes

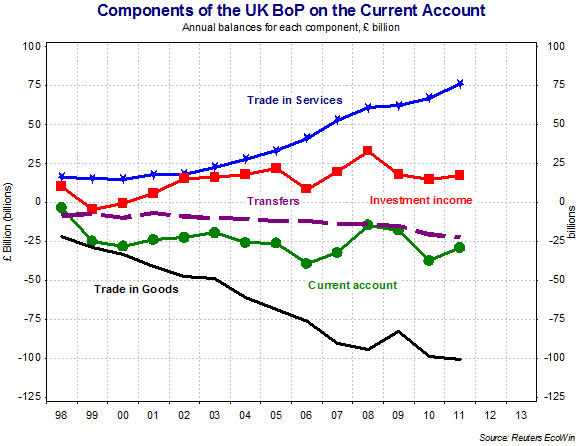

- Trade in goods: visible account

- Trade in services: invisible account consists of transport, tourism and insurance etc.

- Net Income flows: Income flows consist of wages, interest and profits flowing into and out of the country.

- Current transfers of money: Government contributions to and receipts from international organisations and international transfers of money by private individuals and firms.

Watch a Video

The Capital account

- It records flow of funds, into the country (credits) and out of the country (debits), associated with the acquisition or disposal of fixed assets

- Transfers of financial assets by migrants

The financial account

It records the flow of money in and out of a country because of:

Investment (direct and portfolio)

Records primarily long term investments

Direct investments – if a foreign company invests money from abroad in one of its branches or associated companies a country. (Any profit from this investment will be recorded as income outflow on the current account)

Portfolio investment- changes in the holding of paper assets, such as company shares. E.g. If an Indian buys shares in an overseas company, this is an outflow of funds i.e. Debit item

Other financial flows

It consists primarily of various types of short-term monetary movement between a country and the rest of the world. E.g. Deposits by overseas residents in banks in the country and loans to India from abroad are credit items.

Deposits by Indians in overseas banks and loans by Indian banks to overseas residents are debit items.

Short term monetary flows are common between international financial centres to take advantage of differences in interest rates and changes in exchange rates.

Flow to and from the reserves

Every country holds reserves of gold and foreign currencies. Central bank sells some of the reserves to purchase Rupee in the foreign market. It does so in order to support the rate of exchange. Drawing on reserves represents credit item in the balance of payment accounts. Money drawn from the reserves represents an inflow of the BOP.

The surplus elsewhere in the balance of payments can be used to build up the reserves i.e. debits.

Balance of Payment can be favourable or unfavourable (deficit)

Theoretically, the BOP should be zero, meaning that assets (credits) and liabilities (debits) should balance. But in practice this is rarely the case and, thus, the BOP can tell the observer if a country has a deficit or a surplus and from which part of the economy the discrepancies are stemming.

Watch a Video

Current Account Deficits and Exchange rate

The current account is the balance of trade between a country and its trading partners, reflecting all payments between countries for goods, services, interest and  dividends.

dividends.

A deficit in the current account shows the country is spending more on foreign trade than it is earning, and that it is borrowing capital from foreign sources to make up the deficit. In other words, the country requires more foreign currency than it receives through sales of exports, and it supplies more of its own currency than foreigners demand for its products. The excess demand for foreign currency lowers the country's exchange rate until domestic goods and services are cheap enough for foreigners, and foreign assets are too expensive to generate sales for domestic interests.

Implications of a persistent current account deficit

Exchange rate: As discussed earlier, a persistent current account deficit will lead to a fall in the value of the domestic currency.

Another way is to draw on reserves, however if the reserves are run down to rapidly, it may cause a crisis of confidence and foreign investment may withdraw suddenly. Persistent current account deficits will also lead to depletion of foreign exchange reserves.

Indebtedness: If the combined balance is a deficit, then it would have to be covered by borrowings from abroad or attracting deposits from abroad. It might mean paying more interest.

Increase in Interest rates: With a falling exchange rate, the government might have to take more serious monetary measures such as increasing the interest rates. This will attract foreign currency, however, the higher interest rates means compromising the Aggregate Demand in the economy.

Another alternative is to attract foreign investments. However, it leads to greater outflows in interest and dividends in the future.

Methods to correct a persistent current account deficit

Expenditure switching policies

These are policies implemented by the government that attempt to switch the expenditure of domestic consumers away from imports towards domestically produced goods & services.

- devaluating currency: Fixing the domestic currency value at a lower price and thus making exports more attractive. Moreover, imports will become more expensive, thus diverting consumption to domestic goods.

However, expensive imports will lead to imported inflation

- Protectionist measures: Reducing imports by levying tariffs and setting up quotas. Please refer to problems related with protectionism.

Expenditure reducing policies

These are policies implemented by the government that attempt to reduce overall expenditure in the economy, so shifting the AD to the left.

- deflationary fiscal policies: Increasing taxes and reducing government spending.

- deflationary monetary policies: Increasing Interest rates.

However, contractionary fiscal and monetary policies will lead to fall in Aggregate Demand, which is not desirable. This will result in compromising economic growth and higher unemployment.

Supply Side policies

The main objective of the supply side policies is to improve the quantity and quality of factors of production. By achieving efficiency in the production of goods and services, the economy can improve its international competitiveness and increase its exports. This would include

- Improvement in technology

- Improving the education and skill level of its workforce

- Providing better infrastructure

- Privatization

- deregulation

All of the above measures will also attract foreign investment in the economy, which will lead to inflow of foreign currency and improve balance of payment.

Supply-side policy can provide a highly effective policy framework for long term improvement in competitiveness and current account performance. The main problem is that supply-side policy may take decades to work and is not a quick-fix.

Current Account Surplus

A current account surplus occurs when the country’s exports are more than its imports. This is a desirable condition, however it has its own problem associated with it.

A surplus in the long run will lead to the appreciation of the country’s currency which will reduce its export competitiveness.

Lower domestic consumption: Relatively stronger currency will induce people to go in for imported goods, thus harming the domestic consumption and investment. In the long run, it will harm the domestic industry and increase unemployment.

Interesting Read

For UK's BOP data https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments