Definition- Oligopoly

An oligopoly market exists when barriers to entry result in a few mutually dependent companies controlling a substantial portion of a market.

Assumptions of Oligopoly

- Few firms dominate an industry.

- Large proportion of industry's output is shared by a few firms.

- High barriers to entry may be due to economics of scale, legal barriers, aggressive tactics such as advertising or high startup costs

- Products may be identical or differentiated.

- Firms are interdependent and take careful notice of each other's actions.

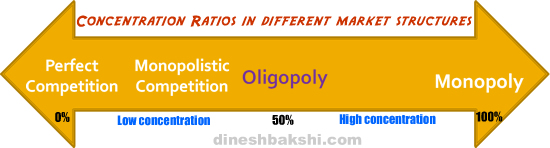

Concentration Ratio

Concentration ratios are usually used to show the extent of market control of the largest firms in the industry and to illustrate the degree to which an industry is oligopolistic.

A concentration ratio is a measure of the total output produced in an industry by a given number of firms in the industry. The most common concentration ratios are the CR4 and the CR8, which means the four and the eight largest firms.

Low concentration

0% to 50%. This category ranges from perfect competition to oligopoly.

Medium concentration

50% to 80%. An industry in this range is likely an oligopoly.

High concentration

80% to 100%. This category ranges from oligopoly to monopoly.

Collusive and non-collusive oligopoly

Many a times, firms under oligopoly collude in order to coordinate prices, limit competition between them and to reduce uncertainties. This is known as collusive oligopoly. This results in firms acting like a monopoly and thus making abnormal profits.

Collusive Oligopoly

Watch a Video - Collusion

There are two types of collusion:

Formal Collusion

It is a formal agreement among firms to undertake planned actions to prevent competition. It is also known as a cartel.

It might include

o Setting production quotas to control output

o Price fixing

o Dividing markets among each other on geographical basis or other factors

Formal collusion is considered illegal in most of the countries which have strict competition/anti-trust laws to prevent and control formal collusion. However, Formal collusion between governments may be permitted. Example, OPEC (Organisation of Petroleum Exporting Countries).

Difficulties in maintaining cartels

There are a number of difficulties or obstacles in forming and maintaining cartels. Some of them are discussed below:

Different firms may have different cost curves: Since, in a cartel the price fixed is common, it might lead to different levels of profits for different firms. Firms with higher AC will have lower profits, whereas firms with lower AC will enjoy higher profits.

Number of firms: An industry with large number of firms will have less chances of having a cartel as it is always difficult to bring them all on consensus in terms of price and output.

Different firms may face different demand curves: Demand curve for a firm depends on the level of market share and product differentiation it commands. This makes it difficult for firms with different demand curves to arrive at a common price.

Incentive to cheat: Colluding firms have an incentive to cheat on the agreement as it might lead to higher profits. This may be in the form of secretly offering lower prices or other concessions. This might lead to the collapse of cartel.

Economic conditions: During recessions, it is difficult to run cartels as the firms may want to lower prices in order to attract more sales. This would also lead to price war and the collapse of a cartel.

Cartels depend of high barriers to entry: Abnormal profits attract more firms to the industry which in turn lowers the industry prices. However, in order to sustain a cartel in the long run, there should be high barriers to entry so that potential new entrants are blocked from entering the industry.

Legal barriers: Most of the countries round the world have strong competitive/anti-trust laws to restrict cartels.

Informal/Tacit Collusion

A collusive situation where the firms are again charging same price and limiting competition, however without any formal agreement.

Types of informal collusion

Price leadership: This occurs when one firm has a clear dominant position in the market and the firms with lower market shares follow the pricing changes driven by the dominant firm.

Limit pricing: It occurs where firms informally agree to set a price that is lower than the profit maximising price. Firms experience lower profits than the highest possible profits and therefore discourage new firms from entering the industry.

Game Theory

Non Collusive Oligopoly

In a non collusive oligopoly the firms do not collude however, they this requires them to be aware of the reactions of the other firms while making pricing decisions.

A non collusive oligopoly will experience price rigidity as the firms are always conscious of the competitors' actions while making price decisions. This can be explained with the helped of a kinked demand curve.

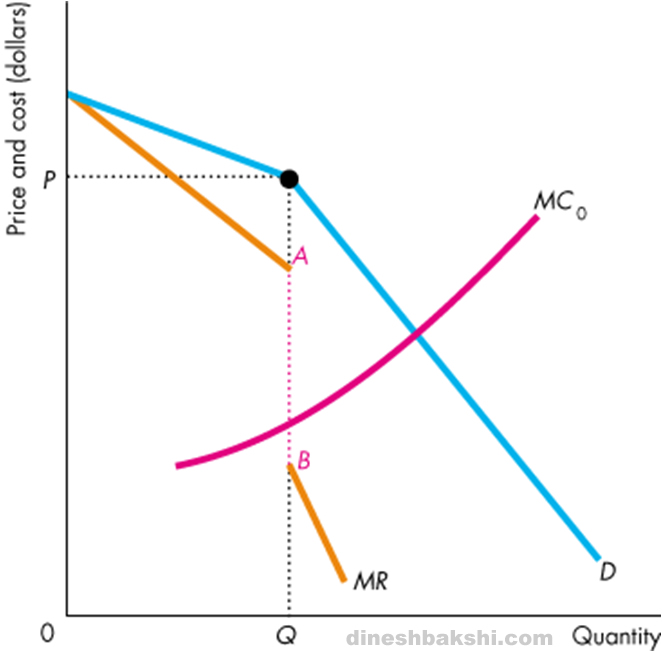

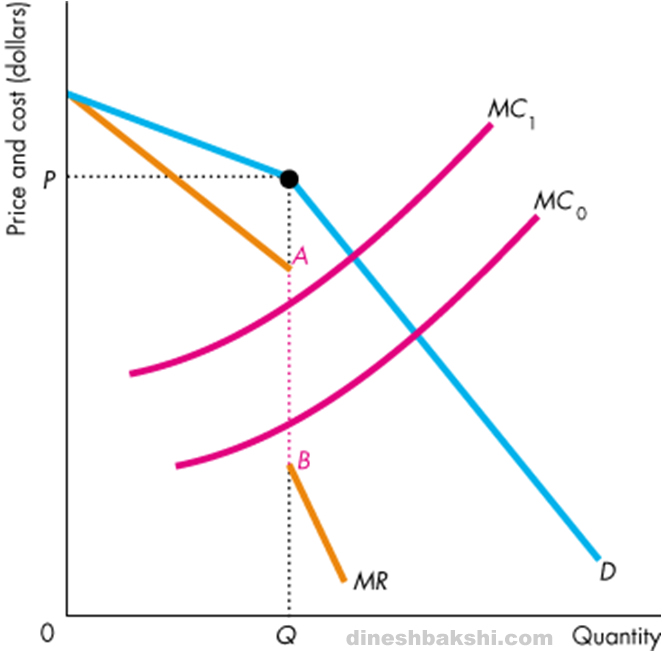

Kinked Demand Curve

Kinked Demand curve was devised by Paul Sweezy, an American economist in the 1930s. The Kinked Demand curve gives an explanation to underlying reason why an oligopolistic market experiences price rigidity.

Lets assume that a firm is selling at price P.

The firm as three options

If the firm increase the Price: If the firm increase the price above its present price P, it is more likely that other firms will not increase their prices. The firm will end up losing customer to other firms. The firm will lose relatively large demand as compared to the price increase. Thus, a firm will face a relatively elastic demand curve above the point 'a'.

If the firm lowers the Price: If the firm lowers the price, it will start a price war and other firms will lower their prices too. It is more likely that the competitors will set their prices even lower than the firm. The firm will not see much increase in its demand even with a relatively high price cut. Thus, the firm will face less elastic demand below the point 'a'.

It should therefore not change the price and should continue to sell at price 'P'.

If we combine both the demand curves we will get a demand curve kinked at point 'a'.

The MR curve will be twice as steeply sloping.

What does Kinked Demand Curve explain?

Kinked demand curve explains the price inflexibility of oligopolistic firms that do not collude.

If the firm lowers its prices the competitors will lower their prices even further and the firm will lose demand and if the firm increase its price, the competitors will not follow by increasing their prices and thus the firm will again lose demand. Therefore, the best strategy is to stick to the existing price level.

In order to avoid a price war firms will compete on other factors rather than price. This is known as non-price competition.

Watch a Video

Watch a Video - Game Theory