The role of fiscal policy

Fiscal policy refers to government policy that attempts to influence the direction of the economy through changes in government taxes or through some spending.

The two main instruments of fiscal policy are government spending and taxation.

Changes in the level and composition of taxation and government spending can impact on the following variables in the economy:

- Aggregate demand and the level of economic activity.

- The pattern of resource allocation.

- The distribution of income.

AD=C+G+I+(X-M)

As we can see in the above equation that G (Government Expenditure) is a component of AD, it can be used by Government to influence AD in the economy. The government can use expansionary or deflationary fiscal policy to get the desired results. Let’s discuss each policy in detail.

Expansionary fiscal policy

Expansionary fiscal policy is used to increase the Aggregate demand in the economy. If the economy is having a deflationary gap, the government can use expansionary fiscal policy to reduce the gap or totally eliminate it.

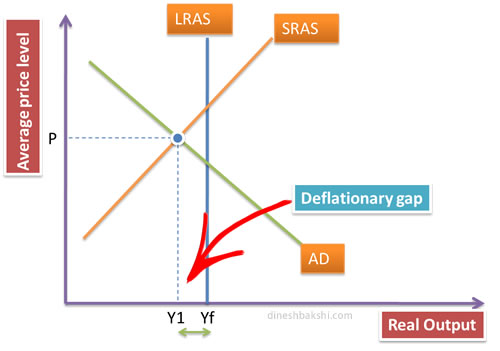

Now, what is deflationary gap?

Deflationary gap is the difference between full level of employment and the actual level of output of the economy. We can see in the diagram below, that the economy is operating a level ‘a’ below the Yf (full level of employment).

The consequence is that due to deflationary gap all the resources of the economy are not being used in the optimum level and they are idle. This results in unemployment and low level of output. This is not desirable for any government. In order to reduce/eliminate the deflationary gap, the government uses expansionary fiscal policy.

Government will either increase its spending or reduce taxes (or both) in order to stimulate the aggregate demand. Increase Government spending will result me more projects being funded by the government and thus employment and output will increase. Even a lower tax rate will result in more disposable income for households and encourage consumption.

Increased G and C will lead to higher AD. However, this might also lead to higher prices/inflation in the economy.

Contractionary fiscal policy

Contractionary fiscal policy involves the reduction of government spending and increase taxes as a measure to control inflation/AD in the economy. With reduced government spending, the AD will fall and thus reduce pressure on the economic resources and the average price level in the economy will come down. Similarly, increased taxes will take away the excess disposable income from the households and result in a fall in AD. Contractionary fiscal policy is thus used to reduce the inflationary gap.

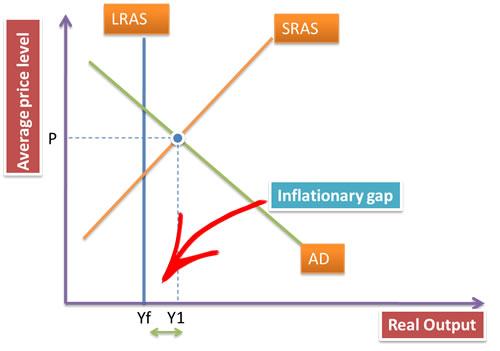

But, what is inflationary gap?

Inflationary gap is when the Aggregate demand exceeds the productive potential of the economy. As we can see through the diagram, the economy is operating at a level above the full employment level of the output. Due the limitation of the economy to fulfil this increased demand the average price level in the economy increases resulting in inflation.

In this case the government can use contractionary fiscal policy to control inflation and bring down the AD.